Deep Dive: Africa’s Mobile Money Boom - A New Frontier for Insurtech

10 June 2025 | Chapter54Africa is the world’s fastest-growing fintech market. At the heart of it is a well-known and booming sector - mobile money. With over 1.1 billion registered accounts, 53% of global share, and $1.1 trillion in transactions in 2024, Sub-Saharan Africa leads mobile money adoption globally. This isn’t just a payments story, it’s a distribution revolution, unlocking adjacent services.

Mobile money platforms now support key insurance services — enrollment, premium payments, claims, and customer education mainly via USSD codes. The GSMA 2024 survey reports that over 28% of mobile money providers now offer insurance products, with demand highest for life, health, and agricultural coverage among over 40 million active subscribers in Kenya, Egypt, Tanzania, Nigeria, Ethiopia, and Senegal alone.. For European Insurtech eyeing new frontiers, this represents a compelling distribution channel.

Market Drivers and Operating Models

Africa’s insurance penetration is still under 3%, which contrasts sharply with the 50%+ in Europe. The issue is not a lack of demand but rather a failure in distribution and affordability. Mobile money is helping to solve both problems, boosted by rampant digitalization: over 8 in 10 citizens (84%) personally own a mobile phone and mobile internet coverage now exceeds 70% across the continent. This supports the scaling of cost-effective digital insurance products. Major platforms like M-PESA, MTN, Momo, Orange Money, Wave, and Airtel Money have become part of everyday life, making them ideal channels for microinsurance distribution.

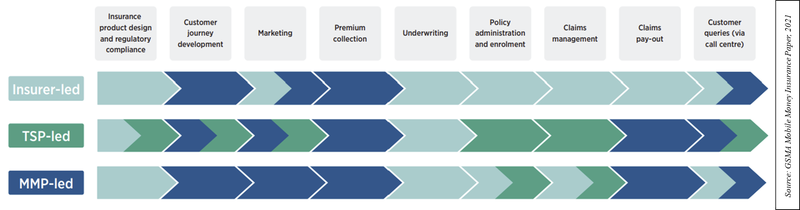

Over time, three main operational models have emerged:

- Insurer-led Model: The insurer designs and delivers the product and is responsible for compliance, policy administration, and claims. Mobile money providers handle payments and may support marketing and customer service. A successful example is SUNU insurance company enabling Orange Money users in Guinea to pay premiums anytime through USSD or app.

- TSP-led: A Technical Service Provider (TSP) takes on design, distribution, IT development, and client management. Since TSPs usually lack underwriting licenses, they rely on insurers for compliance and policy issuance. Using this model, Pula Insurance and BIMA serves over 20 million people with agriculture and health insurance products across Africa.

- Mobile Money Provider-led: The provider controls branding, customer journey, premium collection, and claims payouts. Insurers or TSPs still handle compliance and underwriting. MTN’s aYo operates in Uganda, Ghana, and Zambia, offering airtime-linked and remittance-based life and hospital insurance under this model.

Why Partner with Mobile Money Providers (MMPs)

First, MMPs are trusted brands with deep market presence, especially in remote areas, which helps build customer confidence.

Second, their scale is unmatched; for example, M-PESA has over 68 million active users across Africa, Wave has over 10 million users across West Africa. These numbers show the impressive volumes of users reachable through mobile money.

Third, mobile money simplifies both premium collection and claims payouts. It also reduces the burden of customer verification, as KYC checks are often already done by the mobile provider, although additional checks may be needed for complex products.

Conclusion

Insurtech companies have the tech, capital, and expertise to contribute meaningfully to Africa’s evolving insurance landscape. By serving as TSP or partnering with local players using any of the 3 operating models, they can help close coverage gaps and tap into a fast-growing market.

If you’re a European Insurtech wanting to expand and grow in Africa: Talk to Chapter54, Let’s build your Africa Strategy!